21 February 2024

- New Zealand has the most concentrated domestic aviation market in the world[1] with one airline holding a dominant position (86% of seats in the domestic market), but subject to no economic regulation

- Auckland Airport’s domestic charges have been rock bottom for years – 40 to 50% lower than comparable airports

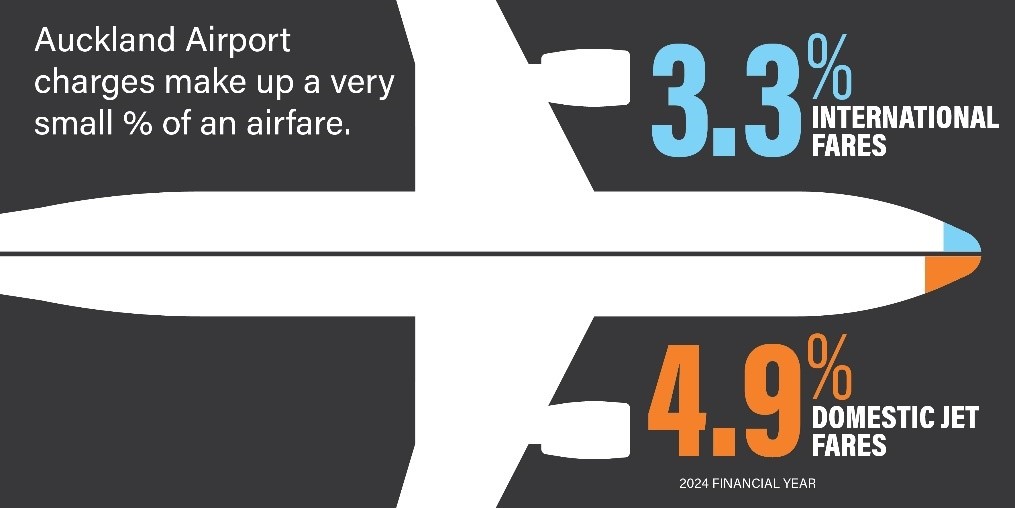

- Charges are currently 3-5% of the cost of an average ticket. By 2027 charges will be similar to current charges at other major airports in our region

- It is wrong to say Auckland Airport’s infrastructure upgrade will make travel unaffordable. Commentary on future prices is speculation as no prices have been set

Airlines protesting about airport regulation and investment is nothing new.

The Commerce Commission is right in the middle of scrutinising what Auckland Airport charges airlines to use essential airport assets with the process due to be completed in September this year.

Today’s move to circumvent the review process is because Air New Zealand has strong commercial incentives to oppose airport investment, both to protect its profit margins and its dominant position in the domestic market. Investment creates additional capacity that enables airline competition – which is good for customers and the cost of airfares.

The post-pandemic rises in airfares, and record profits by airlines in the 2023 financial year, have demonstrated how lucrative constrained capacity can be for airlines, and how much it can cost travellers when demand exceeds supply.

Air New Zealand, which is subject to no economic regulation, holds 86% of New Zealand’s domestic travel market and hiked its average domestic and regional airfares by up to 55% or $70 a fare following the pandemic. This has significant impact on airfares, particularly in the regions. Regional airfares grew 16% between 2022 and 2023 alone. Today airfares across the domestic market remain 32 per cent higher on average compared to pre-pandemic.

New Zealand has one of the least competitive domestic markets in the world and we encourage the Government to follow Australia’s example and actively monitor fares and performance of the market to ensure it is working in the interests of consumers.

We are calling time on the delay tactics.

Auckland Airport is getting on with building the resilient, fit-for-purpose airport that meets the needs of customers and to support our economy. Delaying infrastructure is not in our country’s best interests.

Nor can we build half an airport.

The alternative terminal being promoted by Air New Zealand is a back-of-envelope design that simply isn’t viable.

It’s full of design holes: A bridge to nowhere; no room for essential security screening; lack of space for government border agencies; and missing a delivery facility for the hundreds of trucks that bring in goods each week so the airport can operate, to name a few examples.

Auckland Airport’s charges make up a fraction of the cost of an average airfare – just 3 to 5 per cent.

Auckland domestic charges have been 40-50% lower than other airports for many years, and that has been worth about $470m[2] to Air New Zealand since 2011.

By 2027 Auckland Airport’s domestic charges will be at a similar level to current charges and other major airports in New Zealand. Prices for 2028 and beyond have not been set and remain subject to consultation.

[1] Datasource: Sabre Market Intelligence for 2023 calendar year for domestic markets with more than 5 million seats operated by airlines. New Zealand has most concentrated domestic aviation market in the world with one airline holding 86% of seats in the market

[2] Compared to the average prices charged by Wellington and Christchurch Airports

VIDEO

Drone vision of Auckland Airport’s construction programme: Auckland Airport transformation on Vimeo

Terminal integration: Auckland Airport Terminal Integration on Vimeo

Transport Hub animation only: https://vimeo.com/914962041?share=copy

ENDS

For further information, please contact:

Media:

Libby Middlebrook

Head of Corporate Affairs

+64 21 989 908

[email protected]