18 February 2021

Auckland Airport today announced its financial results for the six months to 31 December 2020.

Auckland Airport Chair Patrick Strange said: “The first half of the 2021 financial year has continued to be a challenging time for both the company and the wider aviation industry. While we were pleased to see domestic travel starting to rebuild, international travel has remained at very low levels.

“The past six months have been a period of constant adjustment for Auckland Airport. We have taken the opportunity to continue our programme to upgrade core infrastructure during this period of low passenger numbers while also supporting the New Zealand government, border agencies and airlines in the operation of a safe border.

“The company has also been hard at work alongside industry, stakeholders and medical experts to help establish a recovery path for New Zealand. One area of focus has been implementing the trial of new testing technologies to improve access to rapid, low-cost, and less invasive COVID-19 testing for our staff working at the border.

“We have also supported the development of a scientific risk-based model to safely manage the risk of COVID-19 across the aviation system. Using a ‘traffic light’ approach to categorise countries using COVID-19 risk data, the model offers a method that could be applied to safely re-establish regular and reliable air connections with low-risk countries like Australia and certain Pacific nations when that approach is combined with New Zealand’s domestic virus management strategy and ongoing controls at the border.”

Mr Strange acknowledged the outstanding efforts of everyone who works at Auckland Airport and noted that they have done a great job in responding to the quickly evolving operating environment and the additional health and safety measures required as a result of the pandemic.

Key performance data for the six months to 31 December 2020:

- Total number of passengers decreased to 2.8 million, down 73.4% on the previous six-month period to 31 December 2019

- Domestic passengers decreased 44.6% to 2.6 million, and international passengers (including transits) decreased 96.8% to 187,003

- Revenue was down 64.9% to 131.5 million

- Operating EBITDAFI was down 68.4% to $88.2 million

- Reported profit after tax was down 80.9% to $28.1 million

- Earnings per share was down 84.1% to 1.91 cents

- Net underlying loss after tax of $10.5 million 1

- Net underlying loss per share of 0.71 cents 1

- No interim dividend will be paid

Chief Executive Adrian Littlewood said the impact of the COVID-19-related travel restrictions continued to be felt across the business in the first half of the 2021 financial year.

“Recognising the ongoing impact that COVID-19 could have on Auckland Airport we took significant steps to reposition the company. Core operating expenses were reduced by $33 million, or 34%, in the six months to 30 December 2020 and we scaled-back our significant infrastructure expansion programme while continuing to focus on upgrading critical infrastructure assets such as runways and roads.

“Nevertheless, the lower number of passengers, especially international and transit passengers, resulted in significant decreases to our key aeronautical, retail and transport income. Revenue from our hotel operations and our investment in Queenstown Airport also declined.

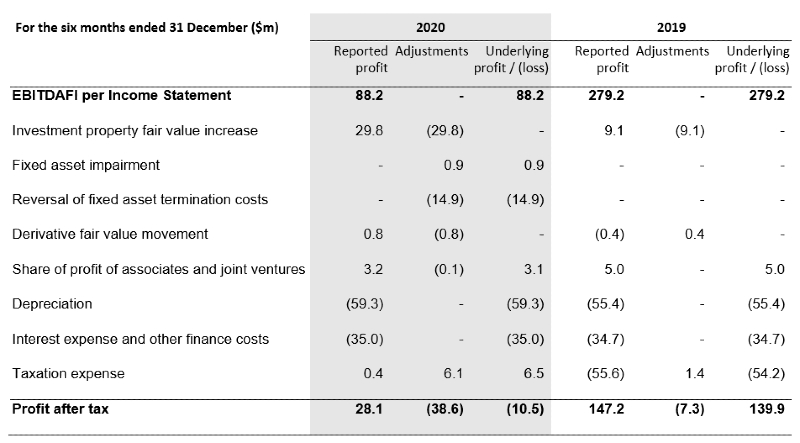

1 We recognise that EBITDAFI and underlying loss are non-GAAP measures. Please refer to the table at the end of the media release for the reconciliation of reported profit after tax to underlying loss after tax.

“The partial recovery of New Zealand’s domestic travel market was a positive sign in the first half of the 2021 financial year. Pleasingly, our domestic passenger numbers have now recovered to around 65% of the pre-pandemic level. This was in part achieved by working very closely with domestic airlines and other businesses operating at the domestic terminal to ensure a high-quality and safe travel experience. It was a real team effort across the airport system, and I want to acknowledge and thank everyone involved in this critical work.

“The ongoing success of Auckland Airport’s commercial property business was a highlight of the first half of the 2021 financial year. Property revenue increased 2.4% to $47 million, driven by rental growth in the existing property portfolio and a part year contribution from the large new Foodstuffs distribution centre.

“We have a number of new commercial developments currently under construction which we expect to be valued at more than $223 million on completion with an annualised rent roll of $116 million. Our commercial property portfolio is now valued at approximately $2.4 billion, up 15% in the year to 31 December 2020. This is an outstanding result that reflects both the underlying quality of our assets and the high-quality approach of our commercial development team.”

Responding to COVID-19 in 1H21

Mr Littlewood said the unprecedented impact of COVID-19 called for a rapid response to best protect Auckland Airport’s travellers, precinct workers, the wider community and its business.

“Our procedures have been completely revised with new operational models to assist travellers and meet new and evolving border requirements. We developed and implemented a comprehensive process that included enhancing cleaning protocols, managing physical distancing, staff protection, new passenger communications, and reorganising the layout of our international terminal to allow for the separation of different categories of passengers. We also worked closely with airlines to help maintain New Zealand’s global freight connectivity. The government’s international air freight capacity support scheme has also been an important facility to ensure New Zealand remains connected to its international markets.

“We were pleased to be the first New Zealand airport to receive Airports Council International’s Airport Health Accreditation – an endorsement of our COVID-19 health and safety measures.

“Despite the impact of the COVID-19-related travel restrictions on the company Auckland Airport was able to continue its support of projects within the local community, many of which were also impacted by the pandemic. Auckland Airport also remained committed to long term sustainability by developing a new 10-year strategy with new targets to guide its activities in relation to diversity, health and safety, resource consumption, and carbon.”

Positioning for the recovery from COVID-19

Throughout the response to COVID-19 we have constantly adjusted our approach to ensure we are best placed to recover and manage through the ongoing uncertainty, said Mr Littlewood.

“As we enter a second year of operating in a pandemic environment we continue to look for opportunities to strengthen our health and safety response, particularly for those at the front line, and help support the development of a path to safely restart two-way connections with our closest neighbours in Australia and the Pacific Islands. Our work in implementing new rapid saliva testing technology for staff and the proposal for a safe model to re-open to low risk countries like Australia are examples and we will continue that work with our colleagues in the aviation and travel industry.

“We have also been reworking our infrastructure development roadmap with airlines to ensure our refreshed plan for developing airport infrastructure reflects the reality of a post-pandemic recovery while serving the needs of our airline customers and the travelling public.

“The low-volume of aeronautical activity has provided a unique opportunity to accelerate select infrastructure upgrades. Most noticeably for visitors to the airport we have continued with a major upgrade of the northern airport access road to include high occupancy vehicle lanes, shared pedestrian and cycle paths, and new wayfinding gantries. We’ve also successfully completed the replacement of more than 360 concrete slabs in the runway’s east and west touchdown zones and made progress on an upgrade of the airside fuel network. In January 2021 we began a pavement upgrade across the airfield’s taxiways and apron and restarted work on a new one-way exit road system for the international terminal in line with our future terminal development plans.

“The momentum in our commercial property business continued with the completion of the 84,000 square metre Foodstuffs warehouse and office and a 10,000 square metre warehouse on Timberly Road. Construction also continued on the structures and façades of the 5-star Te Arikinui Pullman Hotel and the 4-star Mercure Hotel with the fit-out of both hotels scheduled for completion when market conditions improve. A $172 million future property development pipeline to accommodate clients such as EBOS (Healthcare Logistics), Geodis Wilson, Hellmann, DHL and Interwaste will help Auckland Airport’s property business continue to grow.”

Outlook

Mr Littlewood said: “We expect the timing of the recovery will remain uncertain in the coming five months of the 2021 financial year. While we have already seen a partial recovery of domestic travel and the opening of one-way quarantine free travel to Australia, our recovery path is strongly linked to two-way quarantine free trans-Tasman travel.

“Despite the ongoing level of uncertainty around the recovery of trans-Tasman and wider international travel the company is providing underlying earnings guidance for the 2021 financial year of a loss after tax of between $35 million and $55 million.

“Although the government remains committed to restarting two-way trans-Tasman travel, and we support this, for the purposes of this underlying earnings guidance we have assumed there will be no material quarantine-free, two-way Tasman travel during the remainder of the 2021 financial year. It also assumes no further lockdowns of an extended duration during the period.

“Auckland Airport has a strong focus on investing in infrastructure to help position the company for the safe and measured recovery in travel. The company is reducing its capital expenditure guidance for the 2021 financial year to between $200 million and $230 million and we continue to take a measured approach to capital expenditure due to the current trading environment.”

The above guidance is subject to any material adverse events, significant one-off expenses, non-cash fair value changes to property, and any deterioration due to global market conditions or other unforeseeable circumstances.

ENDS

Note 1. Underlying profit / (loss) reconciliation

We have made the following adjustments to show underlying profit / (loss) after tax for the six months ended 31 December 2020 and 2019:

- we have reversed out the impact of revaluations of investment property. An investor should monitor changes in investment property over time as a measure of growing value. However, a change in one particular year is too short to measure long-term performance. Changes between years can be volatile and, consequently, will impact comparisons. Finally, the revaluation is unrealised and, therefore, is not considered when determining dividends in accordance with the dividend policy;

- we have reversed out the impact of fixed asset project write-offs, impairments and termination costs. In response to the COVID-19 outbreak, some capital expenditure projects were abandoned and fully written off and others were suspended. Some of these abandoned or suspended projects incurred contractor termination costs. The abandonment or suspension of live capital expenditure projects is extremely rare and is the direct consequence of COVID-19. These fixed asset write-off costs, impairments and termination costs are not considered to be an element of the group’s normal business activities and on this basis have been excluded from underlying profit;

- we have also reversed out the impact of derivative fair value movements. These are unrealised and relate to basis swaps that do not qualify for hedge accounting on foreign exchange hedges, as well as any ineffective valuation movements in other financial derivatives. The group holds its derivatives to maturity, so any fair value movements are expected to reverse out over their remaining lives;

- we have adjusted the share of profit of associates and joint ventures to reverse out the impacts on those profits from revaluations of investment property and financial derivatives; and

- we have also reversed out the taxation impacts of the above movements in both six-month periods.